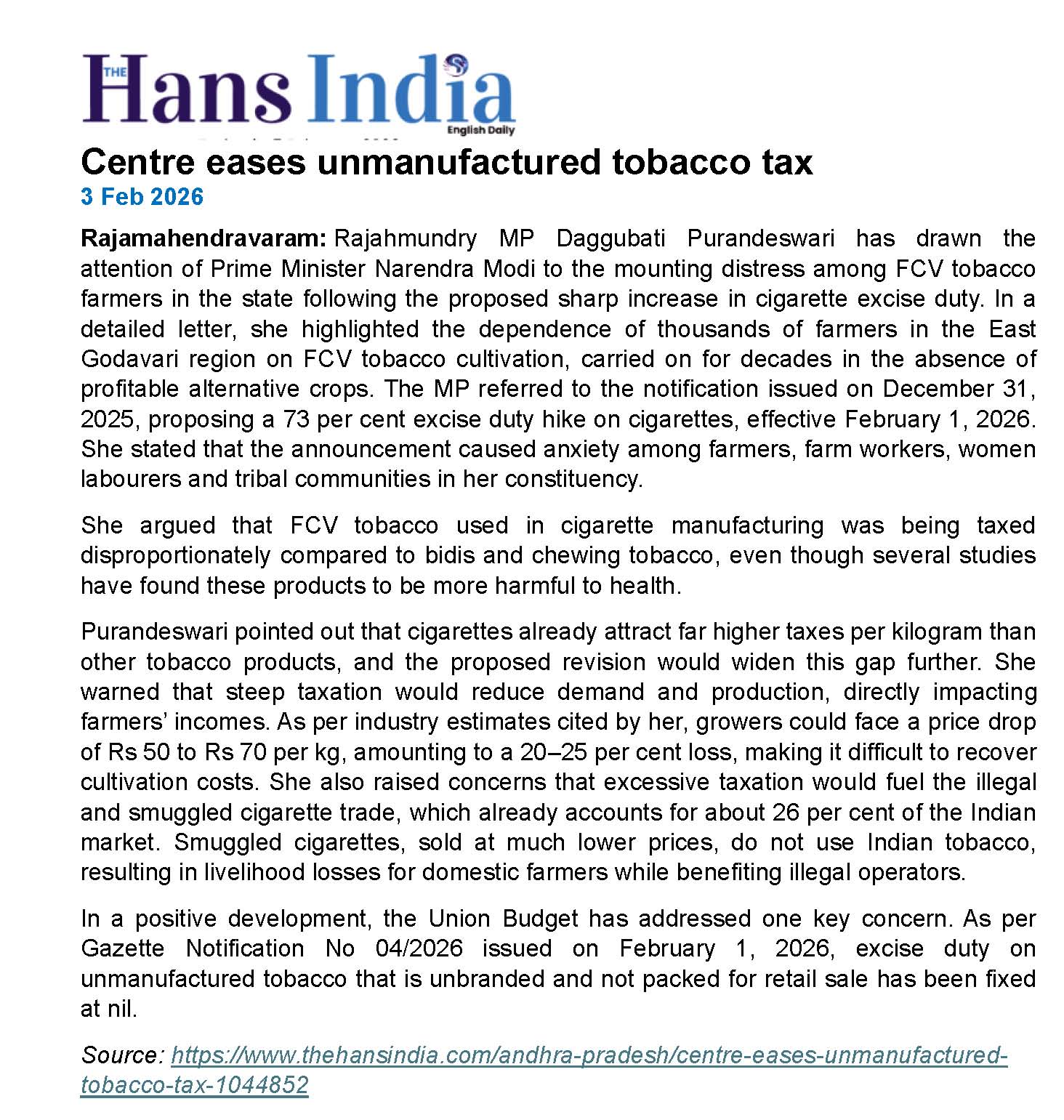

The current tax rates applicable on Cigarettes are as follows:

| Type/ Length of Cigarettes (mm) | GST Rate (on Retail Sale Price) |

Excise Duty | NCCD | ||

| Plains | |||||

| Upto 65 | 40% | Rs. 2050 per thousand | Rs. 230 per thousand | ||

| >65 to 70 | 40% | Rs. 3600 per thousand | Rs. 290 per thousand | ||

| Filters | |||||

| Upto 65 | 40% | Rs. 2100 per thousand | Rs. 510 per thousand | ||

| >65 to 70 | 40% | Rs. 4000 per thousand | Rs. 510 per thousand | ||

| >70 to 75 | 40% | Rs. 5400 per thousand | Rs. 630 per thousand | ||

| Others (>75 mm) | 40% | Rs. 8500 per thousand | Rs. 850 per thousand | ||

These tax rates are effective from February 1, 2026