Illegal Cigarette trade comprising international smuggled and locally manufactured tax-evaded cigarettes accounts for as much as 1/4th of the Cigarette Industry in India. It is estimated that the Government loses Rs. 18,500 crores per annum on account of illegal cigarette trade. Read TII Handbook on Illegal Cigarette Trade

Extremely high and constantly increasing tax rates on Cigarettes provide a profitable opportunity for tax evasion by illegal trade in both international smuggled and domestic tax evaded cigarettes. The escalating and unprecedented tax burden on Legal Cigarettes had more than trebled between 2012 and 2020 as a consequence of successive increases in taxation.

Further, extreme regulations such as Pictorial Health Warnings provide further encouragement to the illegal cigarette trade in India, as illegal cigarettes do not comply with tobacco control regulation of the Government.

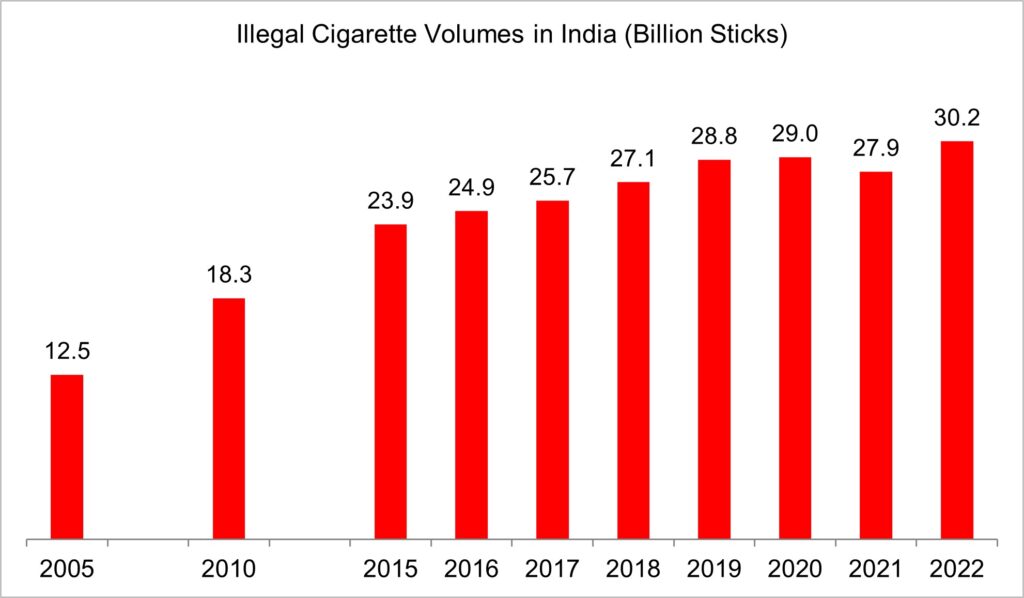

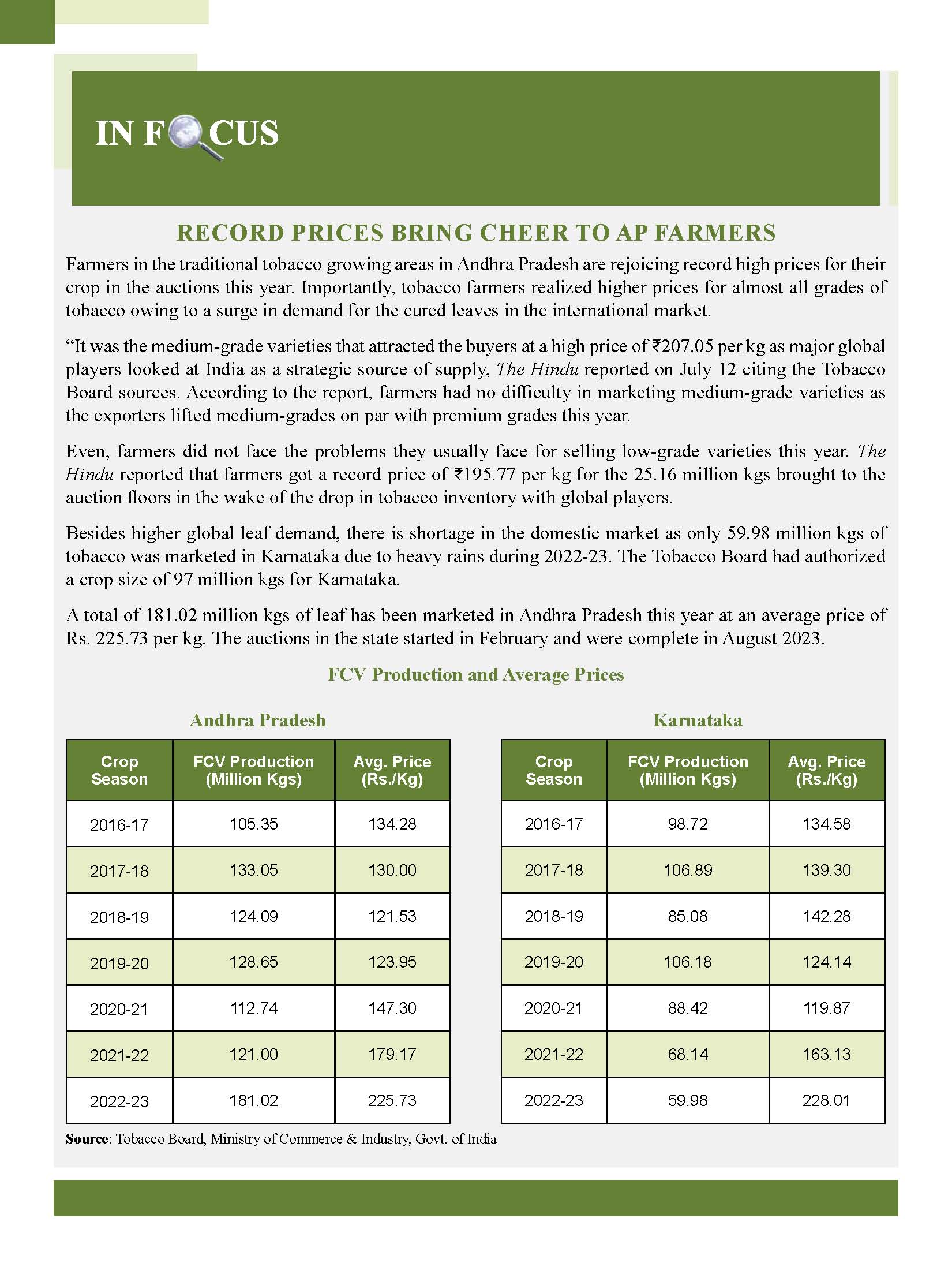

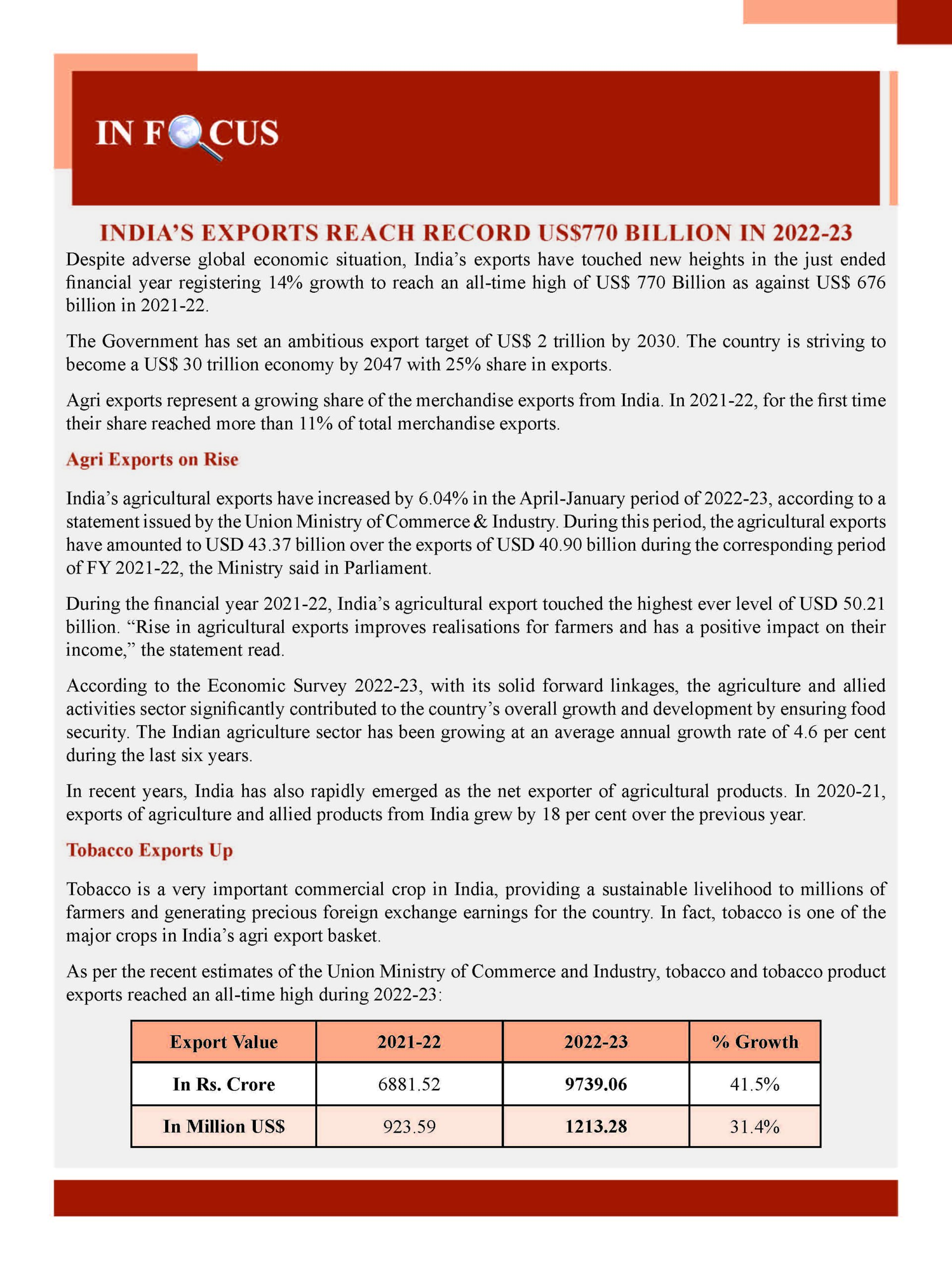

According to the recent data released by Euromonitor International, illicit cigarette volumes have reached 30.2 billion sticks in 2022. This has made India the 3rd largest illicit market (by volume) in the world overtaking Pakistan. China and Brazil are the other two large illicit markets ranked ahead of India.

Source: Euromonitor International, 2023

The availability of International Smuggled Cigarettes has spread all over the country as retailers benefit enormously by pushing sales of these cigarettes due to higher trade margins as these Cigarettes are offered to retailers at extremely low prices compared to Indian manufacture. Illegal cigarettes are sold cheap due to tax evasion affording a huge arbitrage opportunity. Availability of these products spreads across urban as well as rural markets – in metros they are almost universally available. Smuggled Cigarettes are particularly popular among youth as they carry International Brand names and are cheaper than Indian brands. These smuggled cigarettes also do not carry the mandated pictorial warnings.

Another aspect of illegal trade in cigarettes is the large and growing segment of low price domestic tax-evaded cigarettes.

Unscrupulous manufacturers, lured by the huge arbitrage opportunity, have set up units by exploiting the provisions in the I(D&R) Act, 1951. Products from these units are available in the market at Re.1 to Rs.2 per stick (filter cigarette) which is even lower than the applicable tax rates, only possible if taxes are evaded.

Constant increase in tax rates has rendered the legal industry unable to counter the growing illegal Re.1 to Rs.2 filter cigarettes. This has put the legal cigarette industry at a severe disadvantage while enabling a much higher arbitrage opportunity to the illegal operators. Illegal cigarettes are readily available at marketplaces, paan shops and hawkers’ stalls across the country. Indeed, cigarette sellers prefer to stock these brands as their low prices ensure higher trade margins.

Illegal trade seriously undermines the social objectives of tobacco control through the availability of tobacco products at extremely low prices which are also of suspect quality, manufactured under unhygienic conditions.

By not adhering to Regulations such as the Pictorial warnings, illegal cigarettes undermine the tobacco control policies of the Government and deliberately create the impression that these products are safer. In the absence of mandated warnings and other statutory requirements on packaging Illegal cigarettes are easily identifiable at selling outlets.

The illegal trade in cigarettes in India, like rest of the world, is controlled by anti-social, criminal elements in society. Growth in illegal trade implies availability of more funds with these elements to execute their unlawful activities against society. Internationally, it has been determined, for example recently by the US Department of Homeland Security, that profits from cigarette smuggling have been used to fund criminal and terrorist activities posing a huge threat to National Security.

Another undesirable outcome of the growth of illegal trade is that it would further undermine the tobacco control policies of the government and affects farmer earnings. Since contraband products do not use local tobaccos any increase in illegal trade will also impact the livelihood of tobacco farmers in the country as demand for domestic tobaccos will reduce further.

Growing Incidence of Seizures of Illegal Cigarettes

In the recent past, there have been various instances of seizure of illicit cigarettes in the North Eastern part of the country, especially through the porous borders along the Indo Myanmar border. The Indian Government has taken a serious view of the growing illicit cigarette trade and in the past few years, enforcement agencies have made focused efforts to seize illicit cigarette stocks across the country.

Over the past few years, the media has reported several cases of evasion of taxes/duties by dealers in illicit cigarettes which came to light because of raids conducted by Directorate General of GST Intelligence (DGGI).

It is important to note that the reported seizures are only the tip of the gigantic iceberg of a much larger operation. In fact, for every such seizure, multiple consignments escape the surveillance net, due to the overwhelming volumes involved, despite the best efforts of the enforcement authorities. This is evidenced by the widespread availability and universal presence of smuggled cigarettes across markets.