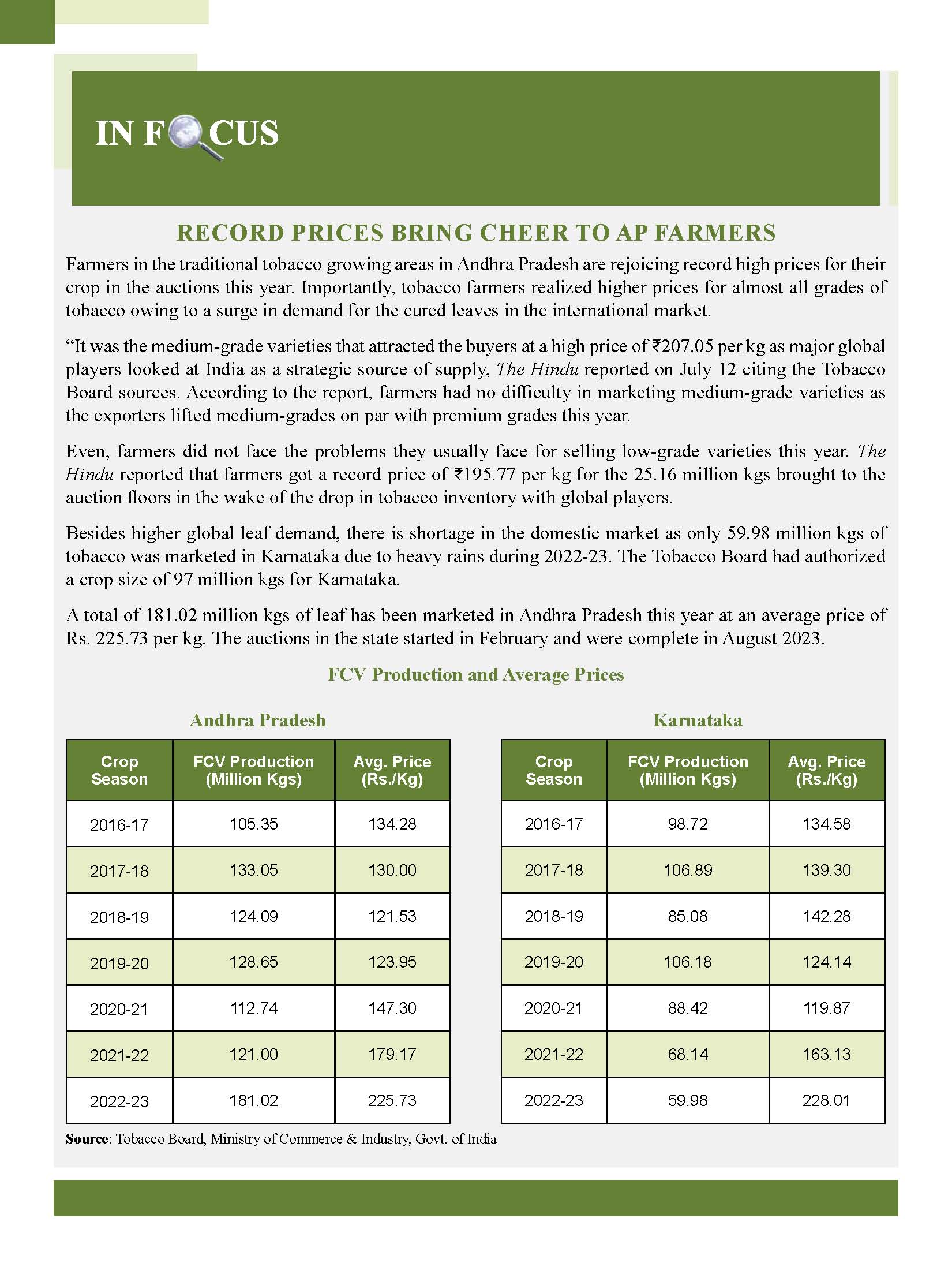

The tobacco consumption pattern in India is unique in that only 9% of total tobacco is consumed in the form of Legal Cigarettes. The remaining 91% consumption is in the form of illegal cigarettes and 29 other cheaper tobacco products such as bidis, chewing tobacco, khaini etc. This is unlike the rest of the world where tobacco consumption is synonymous with cigarettes which account for as much as 90% of total consumption.

Cigarettes bear the brunt of Tobacco Taxation in India

Despite a mere 9% share of consumption, Government collects a very high proportion of its total tobacco revenue from legal cigarettes. The reason for this distorted pattern of revenue collections is that cigarettes are subjected to high and inequitable taxation, as compared to other tobacco products, which are largely produced in the unorganised sector and are prone to tax evasion.

Consequently the legal cigarette share of total tobacco consumption in India has declined from 21% in 1981-82 to 9% in 2021-22. Overall tobacco consumption in the country has increased by 50% during this period.

Tobacco Consumption in India (Million Kgs)

|

Year |

Legal Cigarettes |

Other Tobacco forms* |

Total* |

|||

|

Million Kg. |

Share | Million Kg. | Share | Million Kg. |

Share |

|

|

1981-82 |

86 |

21% | 320 | 79% | 406 | 100% |

| 2021-22 |

54 |

9% |

553 | 91% | 607 | 100% |

| Difference | -32 (-37%) |

+233 (+73%) |

+201 |

|||

Source: USDA; Tobacco Board, Govt. of India; FAO

*Includes illegal cigarettes

Moreover, given the availability of cheap substitutes, there is a great deal of interchangeability and dual usage between consumers of cigarettes, bidis and other tobacco products.

While the legal cigarette industry in India is in the organized sector, has statutory oversight and is completely compliant with all regulations the bulk of tobacco consumed is largely produced in the unorganized sector which does not have compliance or enforcement. This large unorganized sector (estimated at 68% of overall tobacco consumption) pays little tax either due to tax exemptions or evasion. Consequently, while on the one hand revenue collections are being sub-optimized, more importantly, overall tobacco consumption is also increasing.

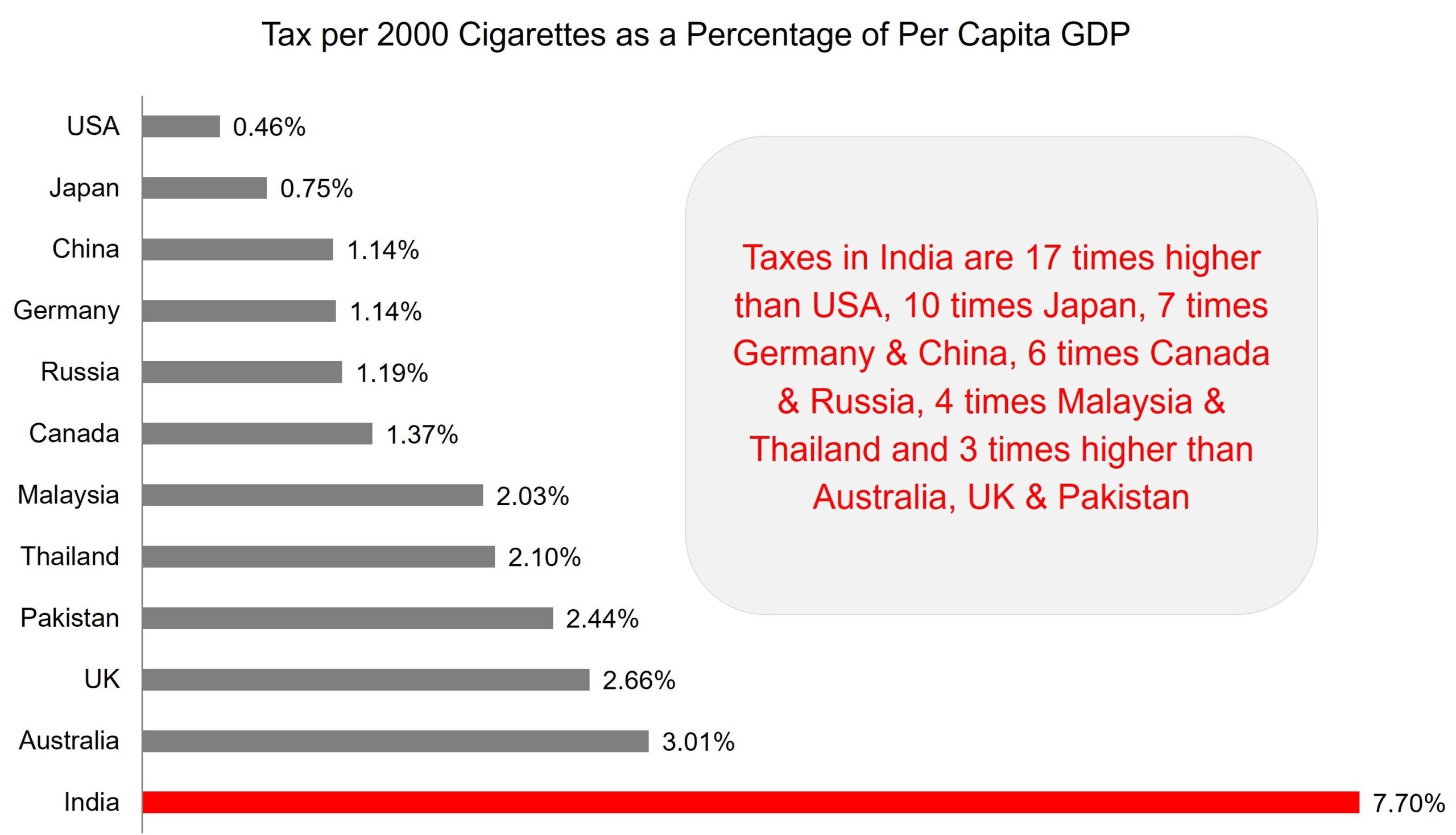

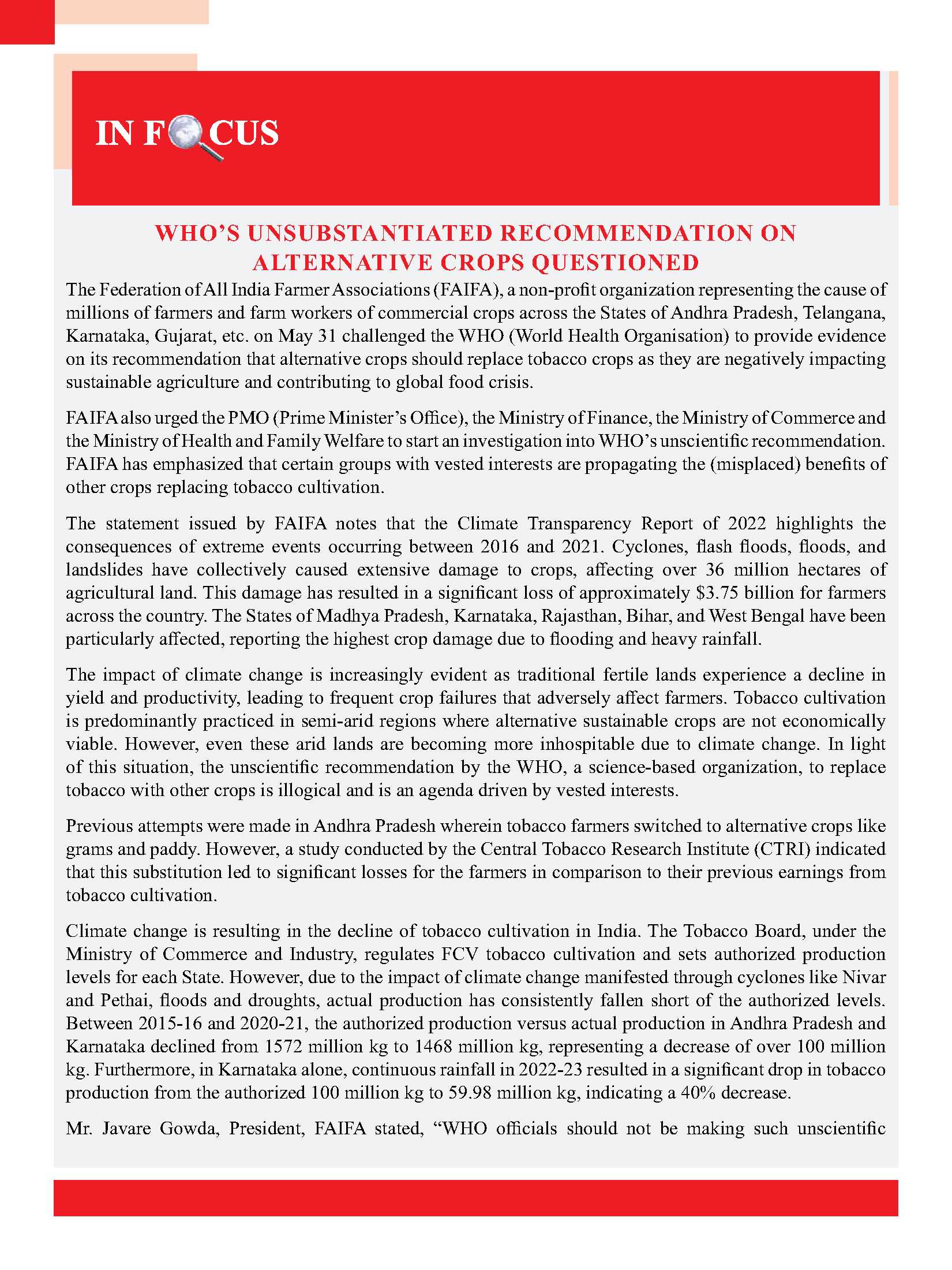

Cigarette taxes in India are the highest in the world

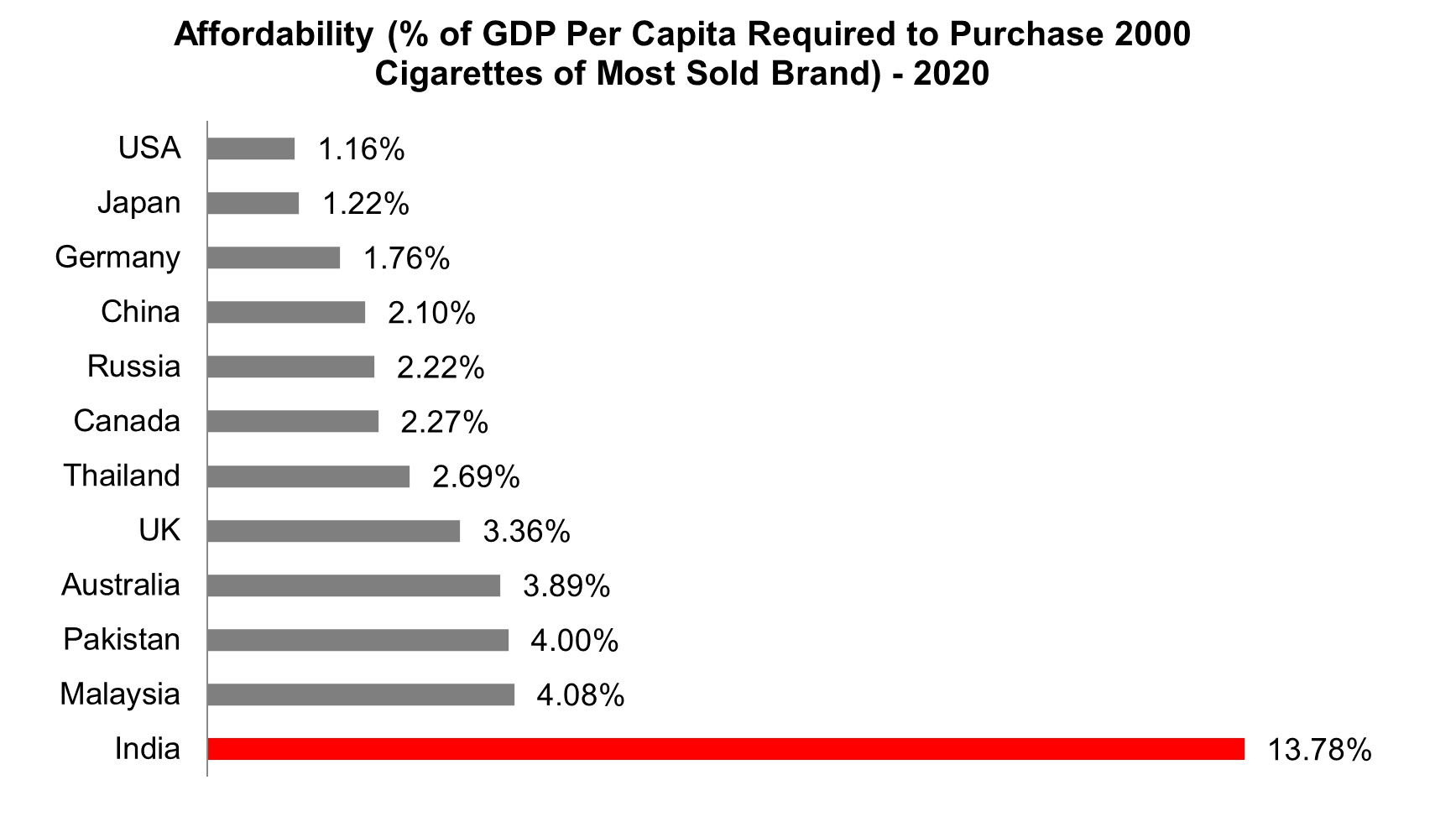

As a percentage of per capita GDP, Cigarette taxes in India, of the most sold brand, are amongst the highest in the world as per the data provided in the WHO Report on the Global Tobacco Epidemic 2021. Consequently, cigarette prices in India, relative to per capita GDP, are also amongst the highest in the world.

Source: Tax data – WHO Report on Global Tobacco Epidemic, 2021; Per Capita GDP – (World Bank)

(Data for the year 2020)

The chart above clearly indicates that high taxes make cigarettes extremely unaffordable in India compared to other countries in the world. It also explains the low per capita cigarette consumption and the high incidence of other cheaper tobacco product forms in the country. Quite evidently this skewed reality also prevents the Government from realizing the full revenue potential from the tobacco sector.

As per the ‘WHO Report on the Global Tobacco Epidemic, 2021, affordability of cigarettes in India was very low compared to other countries. Affordability measured as a proportion of GDP per capita required to purchase 100 packs of 20 cigarettes of most sold brand.

Source: WHO Report on the Global Tobacco Epidemic, 2021

Source: WHO Report on the Global Tobacco Epidemic, 2021

The WHO Report further notes that Between 2010 and 2020, the affordability of legal tax paid cigarettes has reduced from 11.10% in 2010 to 13.78% in 2020 (Higher percentage indicated lower affordability).

The reason for this disparity and the low affordability of cigarettes in India is punitive taxation and the continuous tax increases that have been much ahead of inflation and the improvement in income levels in the country.

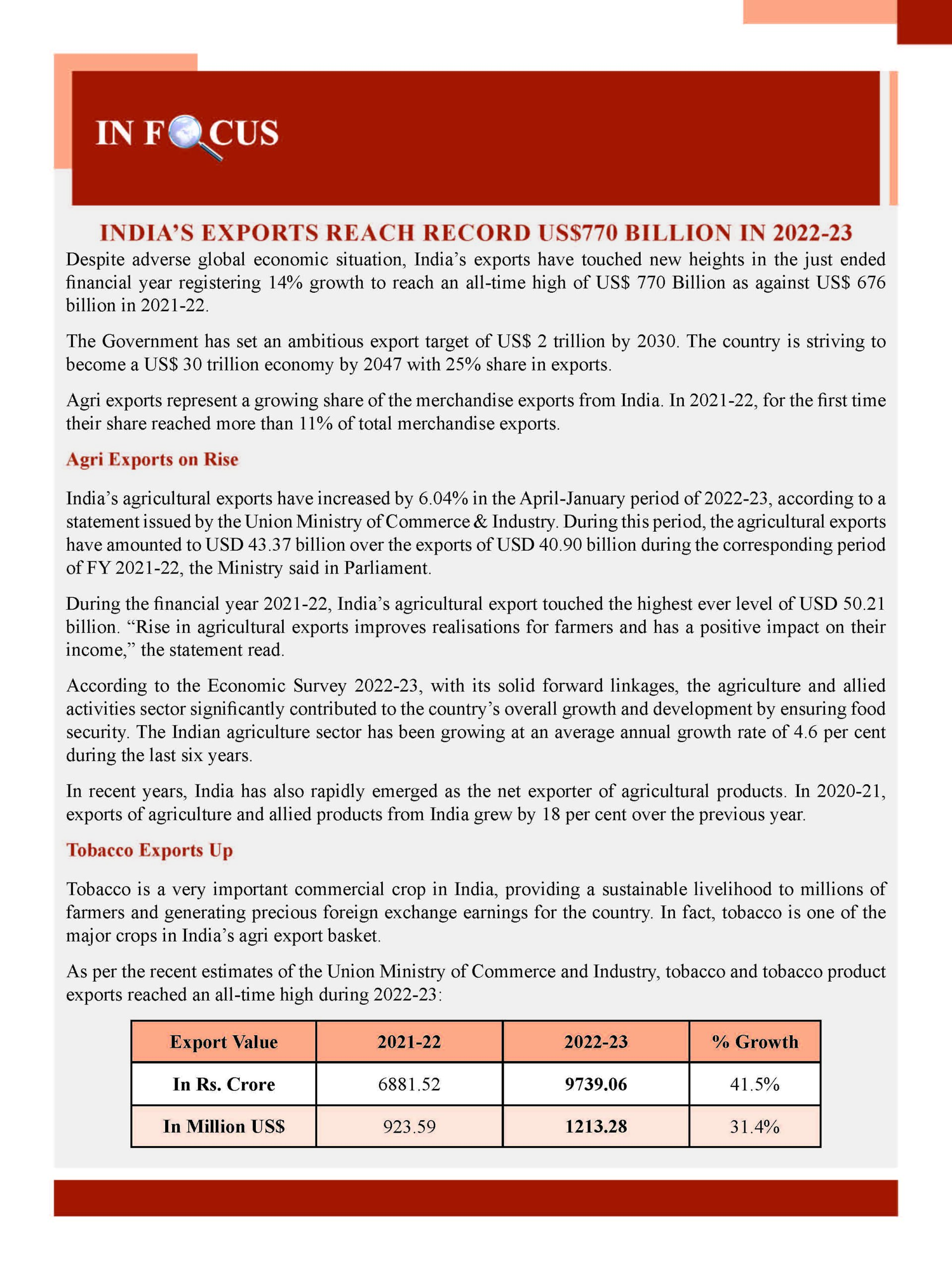

GST Regime Increases Tax Burden on Cigarettes

The Goods and Services Tax (GST) regime, introduced in July 2017, increased the tax burden on Cigarettes by increasing the GST Compensation Cess rates by a weighted average of about 13% over the pre-GST tax rates. Incidence of taxes on cigarettes after accounting for the GST Cess increase has more than trebled between 2012 and 2020. The highest GST rate of 28% is levied on cigarettes in addition to the GST Compensation Cess, National Calamity Contingent Duty (NCCD) and Basic Excise Duty (BED).

The Union Budget for 2019-20 imposed BED at the rate of Rs. 5 to 10 per thousand sticks for various length segments of Cigarettes, which was earlier ‘Nil’. Further, the Union Budget for 2020-21 increased NCCD on cigarettes and other tobacco products. Accordingly, the NCCD on Cigarettes increased across all length segments ranging from Rs. 200 per thousand sticks (earlier Rs. 90) on the lowest length segment to Rs 735 per thousand sticks (earlier Rs. 235) on the highest segment.

During the period of high tax increases, Legal Cigarette Industry volumes saw a severe decline. Shipments from factories dropped by a massive 28% to 79 billion sticks in 2020-21 from a level of 109 billion sticks in 2012-13. Overall tobacco consumption, however, continued to grow due to shift in consumption from duty paid cigarettes to illicit cigarettes and other tax-inefficient forms of tobacco.

On the contrary, stability in taxes, particularly in 21-22 and 22-23, has helped in decelerating the growth momentum of illicit cigarettes and allowed the legal industry to clawback some volumes from the illicit trade. This has provided robust revenue growth for the exchequer.