01Tobacco consumption pattern in India is unique

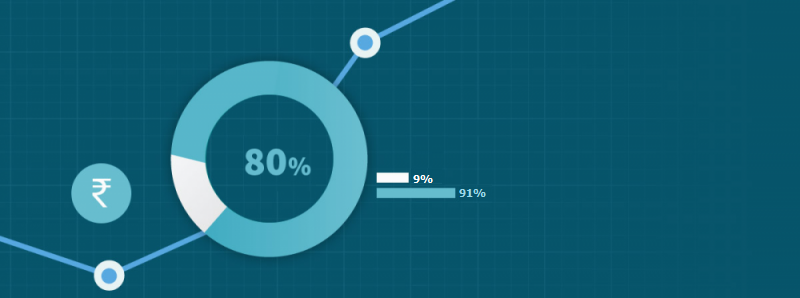

Legal cigarettes account for just 9% of overall tobacco consumed in India. The remaining 91% of consumption is in the form of illegal cigarettes and 29 tax -inefficient tobacco products such as bidis, chewing tobacco, khaini etc.

This is unlike the rest of the world where tobacco is synonymous with cigarettes, representing 90% of tobacco consumption.

02Legal Cigarette Industry is the primary Tobacco revenue contributor to the Govt.

Tobacco & Tobacco Products are a large contributor to the Government's Tax Revenue. As per the Lok Sabha, Unstarred Question No. 1499 dated 28th July 2023, tobacco products including pan masala generate Tax revenues amounting to more than Rs.72,000 crores annually. Legal cigarettes contribute a very high proportion of the total tobacco tax revenue despite accounting for just 9% share of tobacco consumption.

03Tobacco is a very important commercial crop in India

India is the world’s 2nd largest producer and a major exporter of tobacco. With an estimated annual production of 800 million kgs., tobacco is an extremely important commercial crop in the country, providing livelihood to 45.7 million people.

As per the Lok Sabha, Unstarred Question No. 1499 dated 28th July 2023, Tobacco products, including pan masala generate Tax revenues amounting to more than Rs.72,000 crores annually.

04The Growth of illegal Cigarette trade poses serious threat in India

Illegal Cigarette trade accounts for as much as 1/3rd of the legal Cigarette Industry in India, causing an annual revenue loss of estimated Rs. 18,500 crores per annum.

Extremely high tax rates on Cigarettes provide a profitable opportunity for tax evasion thereby encouraging growth in illegal trade.

Recent Additions & Highlights

Tobacco Industry Latest Publications

Latest News

Apr

The Tobacco Institute of India

International Trade Tower, 316-318, 3rd Floor, Block 'E'

Nehru Place, New Delhi – 110019

Ph: 011-26231214/15/16, Fax: 011-26468482

E-mail: tii@tiionline.org